I get that it’s satire but it makes a good point. It is the government’s problem that renting out property is financially incentivized. We can’t expect any significant number of landlords to start charging below market rent. Especially because many of those landlords are public corporations who must act in the interest of their shareholders, directly against the interests of their tenants. This is the government’s problem to regulate and in absence of the regulation effort is better spent targeting government than individual landlords/corporations imo. Ya the government won’t do anything, they are the landlords after all, but at least there’s a path to changing the financial incentive through government.

This has to be satire. TELL ME IT’S SATIRE!

Yes, this is a satire account, but I’ve heard the exact same crap from so-called “small landlords” who think clearly the problem is someone else.

Every small contributor that makes up the bulk of the problem thinks the REAL problem is the one that’s bigger than them and they’re the small potatoes, or the good one.

This applies to EVERYTHING. Not just property.

There should be nothing wrong with owning multiple houses. But your property tax should be adjusted on every house you own depending on the number of houses that own. It should be completely cost prohibitive at a certain point to own more than 2 or 3 homes. It should kick in after a year or two, so that it gives people more than enough time to purchase a new home, fix it up or renovate, and then time to sell the previous house. Owning houses shouldn’t be a profit-making venture.

Societal problems should be solved by the government, not by individual actions.

At a practical level, I agree with you.

That DOESN’T mean that if you do shitty things just because they’re legal, you get to be exempted from people’s judgement.

For example, shorting stocks and collapsing basically profitable companies for short-term gains is totally legal. Doing it still makes you a piece of trash, and I will judge you, and encourage others to judge you, as such.

I’ve had two good small landlords and a few bad ones, and all corporate landlords have been bad except for one that was okay aside from the semi annual fire evacuations for the laundry room

the good landlords were renting at fair prices and doing honest work. the bad ones were overcharging for students and not doing a fucking thing, including several months where the basement was slowly flooding through the foundation and I had half my carpet pulled up

I don’t have a problem with the good landlords who rented out their long since paid off crappy but maintained place for students at fair prices. it’s the hoarding, price gouging, and not putting a fucking cent back into it that pisses me off.

It’s like… I try to think of what an “ethical landlord” might look like, and I just can’t picture it. Realistically the only “”“service”“” they provide is not having to save for a down payment and fixing things that break*(I know they don’t, but I’m trying to imagine what it would take for one to be ethical, so they actually would be in this hypothetical)*. The things a land lord will take care the ability of their tenants to build equity. That’s the benefit of owning. Pro-landlord people will say landlords take the risk of property values decreasing, but that’s pretty rare. Especially considering landlords inherently are taking up stock. So to be generous I’ll assume property value is static.

Even in this crazy optimistic, crazy generous hypothetical, land lords still rob tenants of equity because they aren’t able to get a down payment together. The only thing I can see making it fair is the landlord gives that equity back, either by charging exactly what the property’s mortgage is or transferring a portion of the ownership over every payment and… Now wait a second… This sounds like… BANKS. A MORTGAGE. Seriously. Every time I try to imagine what it would take to really really be an ethical landlord it just comes back to being a bank or mortgage.

Maybe there’s some place for folks to act as very very small banks and give a mortgage to someone like this, but like… It’s so convoluted.

TLDR: I view them as leeches even when I’m giving them every benefit of the doubt in a favorable hypothetical.

Lots of people seem to be missing this - Chase Passive Income is a satirical account.

I don’t know how they could miss that. It is very clearly a satirical post. No rich people are either that self aware or interested in outing themselves as greedy useless pieces of shit.

Its real like the goldmen Sachs elevator

Yeah, lots of people on Lemmy are so sanctimonious while simultaneously falling for the most obvious satire/ragebait imaginable, lol.

Yeah this one or the bicycle meme

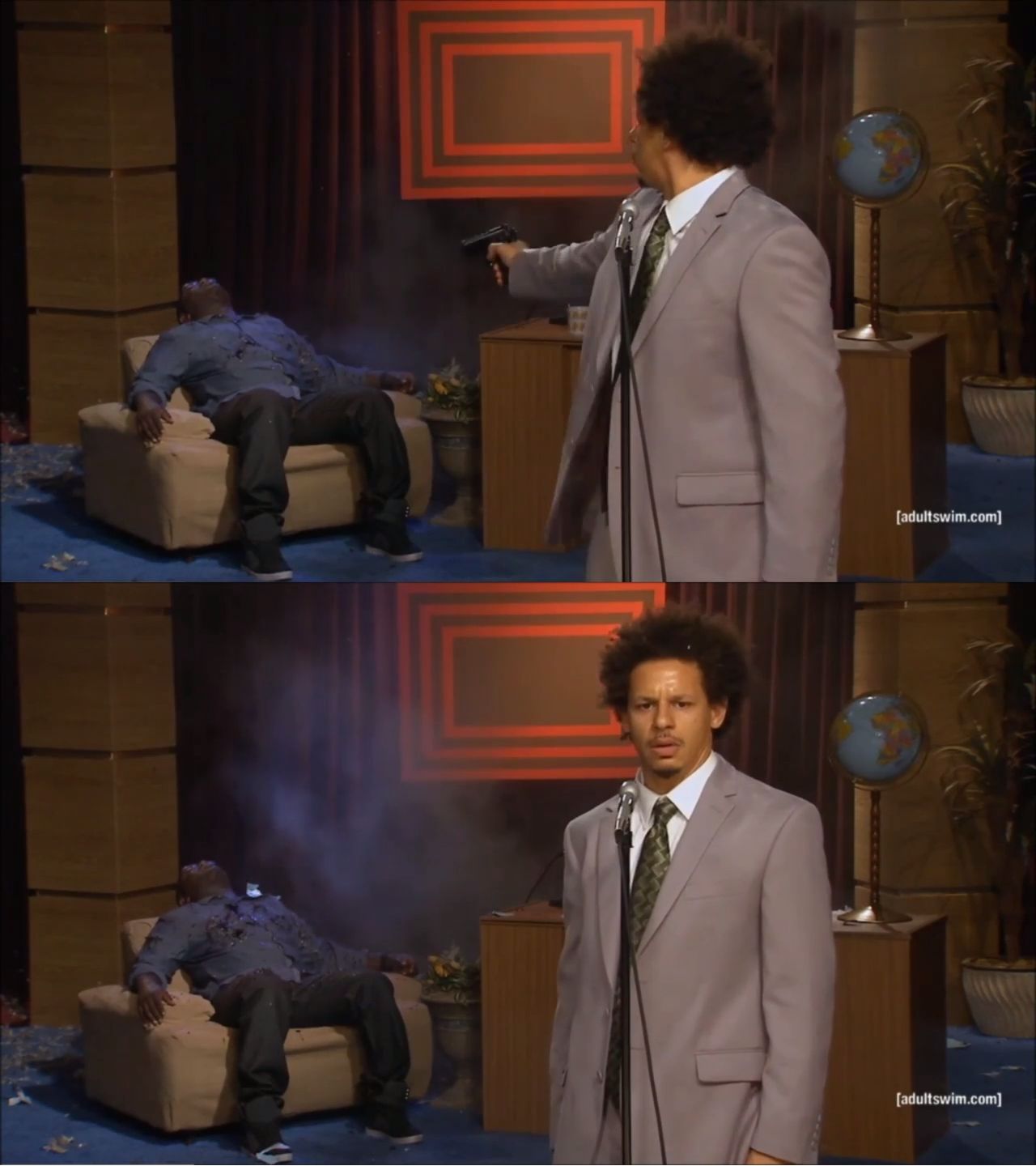

He’s not getting hurt like in the bicycle meme though, just hurting others.

Well he’ll be fine right up until he falls seventeen stories from a two storey building

A rent strike that bankrupts him (assuming he’s leveraged on these homes) would be better. Especially if it means the houses get auctioned at a discount, and he has to rent a place to live afterwords.

We really need a nation wide rent strike to battle the investor bullshit that’s making housing so fucked up.

You don’t fix a systemic problem by taking revenge on those who were lucky enough to benefit from that system, unless, maybe, if they are working to maintain or propagate it.

I can walk into a bank today with a mortgage cheaper than rent, and I’ll be denied cause I don’t make enough money, explain that logic to me.

Landlords don’t care if your rent is sustainable for you in the long term. They have nothing to lose if at one point you can’t afford it anymore, someone else will.

Banks on the other hand care very much if you’ll be able to pay your loan in full. Even with the house as collateral, it’s much better for them if you just paid your loan instead of them having to deal with all that.

“they get the house if you don’t pay” really isn’t so great after you’ve look at what they actually get for those houses.

Generally, people don’t get foreclosed on when their house looks super fancy and well maintained.

Also debt is an asset for banks. Having people in debt for 30 years is better than having people in debt for 10 years and then selling their house.

They only get to force the sale of the house to recoup their loan, you get to keep the extra from the sale. House sells for $300k, you owed $250k you walk away with $50k and the bank gets their money back.

But on auction, the bid is usually FAR below the normal asking price.

The counter-intuitive solution is probably to make it easier for banks to evict people for not paying their mortgage.

In most of the US, foreclosures are a legal process that requires a court order. The bank has to take the borrower to court, prove the loan is not paid, and then the court has to find in favour of the bank and then issue an order to have the sheriff auction off the property.

In many cases, these auctions will result in the property sold far below market value because the borrower will drag their feet and not co-operate. In many cases, buyers can’t do a thorough house inspection and thus the hammer price suffers because they have to account for that risk.

The bootlicker-sounding but actually smart solution, if you consider it beyond the initial knee jerk reaction, is to make it so that when the court enters a foreclosure order, the homeowner is immediately evicted and the house is now in the custody of the State until it is sold. The borrowers can have a reasonable time to leave, but when they do, the sheriff should then open the property to the public for inspection and hire or allow buyers to hire house inspectors, perform title searches, and all the other formalities associated with selling a house in the ordinary manner.

All buyers then submit written offers (bids) to the sheriff like they would for any other house purchase but these bids would be published to avoid accusations of impropriety; the highest bidder gets the house. As with any other auction, the bank bids the amount of the mortgage plus court costs as a baseline. After it is sold, the sheriff takes the traditional 6 per cent estate agent fee for their trouble and then pays off the bank and the remainder goes to the borrower.

As terrible as it sounds for the ordinary borrower, this actually results in a better outcome for them because it would result in a higher sale price for the house, meaning the mortgage is lower risk for the bank by reducing the likelihood that the bank bid is the highest, allowing them to extend those loans to more people, and a defaulted borrower gets more of their money back in the end.

When the underlying problem is insufficient supply in the locations people want to live, anything that gives average person more purchasing power (such as making banks comfortable with larger loans) just drives up the price even higher.

Densifying metro areas (the places people are moving to) is the only real solution. Otherwise the price has to be unaffordable for the average person, to drive them into finding a way to live in a more rural area or to put up with a multiple-roommate living arrangement.

While I agree with this principle generally, and I believe that if my solution were to be implemented it would need to be alongside other schemes like increased public housing projects, relaxing zoning laws to allow densification, and anti-scalping measures like a quadratic property tax.

But even if my suggestion were implemented alone, it wouldn’t result in increased prices. That’s got to do with the fact that ordinary people, right now in the US, largely do not bid in foreclosure auctions. All that housing supply is actually not going to end consumers at all. The type of people who would bid at foreclosure auctions are not those who want to live in the house but in many cases, those who want to resell it. Making the foreclosure process more similar to normal house-buying and thereby increasing the hammer prices drives out scalpers and flippers because it’s not profitable for them any more. Hell, if you’ve seen the videos these people post, they start pulling back even if the price is tens of thousands of dollars under market.

…the mortgage is lower risk for the bank… allowing them to extend those loans to more people

That was the part I meant about this proposal increasing demand by giving the average person more purchasing power.

Multiple strategies makes sense. Quadratic property tax is a new one to me, and it confused Google. Is it like a progressive tax, where larger valuations are taxed at a higher rate?

It gives the average person more purchasing power but it also opens up new supply by opening the foreclosure auctions to the average person. The increased demand I argue is partially or wholly counteracted by pushing out the house flippers from the foreclosure markets; those people are generally only interested in buying properties at severely under market prices at foreclosure auctions or similar sales. Essentially, I am saying that the entire “flipper” business model should be destroyed as it does not provide sufficient value to the taxpayer to offset its negative effect on the market and this policy could do severe damage to that sector.

Quadratic property tax is a combination of the “quadratic” nature of quadratic voting and, of course, taxation. I made this term up hoping people would know what I was talking about but it turned out to not be as obvious as I initially thought.

Essentially, the taxation scheme takes into account the number of lots owned by a person in addition to the value per lot. Consider the following sample scheme:

The amount of tax due on any given property is calculated according to the following formula: r×(1 + Np)²×V, where N is the number of lots owned by the taxpayer beyond the first and V is the value of the lot. The variables r and p are determined by the local taxing authority which correspond to tax rate (higher = more tax per unit of money) and the penalty for owning excessive numbers of lots (higher = greater penalty for owning multiple lots).

If a local taxing authority selects values r = 0.002 and p = 0.05, the tax due for a lot worth 100 units of money would be as follows:

- An individual or family who owns only that lot pays 0.002 × (1+0×0.05)²×100 = 0.2 units of money per year.

- A small individual landlord who owns this property and 2 others would pay 0.002 × (1+2×0.05)²×100 = 0.242 units of money per year.

- A corporation who owns this property and 10 others would pay 0.002 × (1+10×0.05)²×100 = 0.45 units of money per year, which is more than double the individual family

- A huge real estate conglomerate who owns this property and 100 others would pay 0.002 × (1+100×0.05)²×100 = 7.2 units, which is so high that it probably would not be profitable to even own this property.

It is “quadratic” because the tax rate scales with the square of the number of previous lots owned.

Coupled with counting rules that ignore subsidiary corporate entities for the purpose of determining ownership, finely-tuning values of r and p will discourage corporate ownership of housing without punishing individual homeowners or small-time landlords.

While this strategy has not been tried in real life to my knowledge, interestingly, some Minecraft servers have implemented a similar scheme to prevent hoarding of desirable lots in the overworld to varying degrees of success, mostly depending on whether those in charge admit any loopholes for privileged players to exploit.

If something were to happen, and you couldn’t make rent, you might get evicted, which would be inconvenient.

If something were to happen, and you couldn’t make the mortgage, the bank might lose money, which is unconscionable.

But the bank can take the house as collateral, what are they even losing?

Probably much easier to have someone reliably pay than to have to go through all the processes of defaulting, repossessing, renovating/repairing, and reselling.

Not sure if you’re in America but credit scores are some rigged ass bs. What do you mean paying off a loan made my score lower?? I have more disposable income!

What do you mean paying off a loan made my score lower??

It doesn’t, you just don’t know how it works.

You’re probably seeing that on Credit Karma, which uses a score that stops counting closed loans immediately, whereas the actual credit reporting bureaus’ systems have them stay on your credit report for 10 years from the date of closure. While they remain, they do continue to count toward your average age of accounts (AAoA) in most scoring models (including FICO). That means even closed accounts can help keep your average age higher.

And given that your average account age doesn’t need to be anywhere close to 10 for you to have ‘perfect’ (750 and above puts you in the highest tier in the eyes of every lender) credit (hell, account age is only like 15% of the score), this is actually not an issue, at all. My average account age is less than 8 years and my score’s over 800. Just make your payments on time and you’re good. You don’t even need to accrue any interest—using a credit card and paying it completely off every month works just fine, that’s what I do.

I have more disposable income!

Having income isn’t proof you can be relied on to promptly pay back a loan, having a history of having promptly paid back loans is. A third of people making over $200,000 a year live paycheck to paycheck—just because you’re making money doesn’t mean you’re a responsible borrower.

You know, I don’t even get that. Banks make a decent amount of money on those mortgages, it used to be their bread and butter after all. What is the problem, it doesn’t make enough money fast enough? Why are there no other banks filling in the obvious financing hole?

You’re no longer proving continously that you can keep paying reliably (yes it’s dumbass logic)

It’s your credit age actually, it gets cumulatively lower because whatever loan it is isn’t adding to your credit age, which is absolutely ridiculous.

Ah, yes, “it’s taken this dude longer than this other dude to pay off his debt, surely we want to give him MORE credit”

It’s designed so that “sweet spot” customers have the best credit scores, those who have enough to reliably pay but not enough to pay it off any time soon.

Bullshit, my score’s in the 800s and all I do is use my credit card for everyday purchases, and pay it off every month. I never carry a balance or pay a cent of interest, nor do I have any installment loans (car loan, etc.) at all.

Tons of confident incorrectness in this thread.

Had that happen a few years ago. Banks are in on the landlord scheme and they can go fuck themselves. Unfortunately it’s literally impossible to live without a bank today. At least in my country.

Haha number go up

Thats wild, is your credit scored fucked?

Income is a massive part of how they determine if you can repay the loan. I personally have an exceptionally high credit score and about double my home’s value in investments. Because of my low reported income, it was a total pain getting a loan.

income is not a massive part of how you can repay the loan. Income can fluctuate over a 10-20 year period. I’ve had the opposite, I have a good credit score, good spending habits and was able to show that although my income is average I can accommodate the mortgage payments. If you made 90k but had a bad credit score and spent wastefully you would get denied for someone on 55k who has a good credit sore and lives within their means, has savings etc.

Debt to income ratio. Saying income isn’t a massive part of loans is just wrong.

Saying it is a massive part of loans is wrong. If you had 150k a year income and your expenses were 150k a year you would never get approved. Income is one thing they look at but i wouldnt say its a massive part of the equation.

…debt to INCOME ratio. Debt is important here, as is the other half of the equation.

In your example, if the individual’s income doubled would they likely be able to secure another loan?

I am not going to respond again, it’s not my job to educate you.

Have you tried lately? Just curious.

That’s very nice. Now please face the wall.

Is this satire?

Yes.

The fact that we have to ask this is the point I think… Hilarious post btw! 🤣

This isn’t small timers, it’s corporations buying up all of the housing, building only “luxury” apartments and price fixing the fuck out of the rent.

Then they spout “Trickle Down Housing” where the “luxury” apartments will be available in 30 years.

The guy said “these houses, …each” so he could own the whole area and jack up the rents, not be a small timer. But yeah, it’s not the person renting out Grandma’s old place to help pay for her nursing home.

deleted by creator

I might be wrong but the % of homes owned by corporations is really tiny. low single digits if I remember correctly.

Yeah, I don’t think so, lol. You’re going to have to produce the source. This is from September of last year and doesn’t include rental apartment buildings.

GAO reported that there were 450,000 single-family rental homes owned by institutional investors as of 2022. However, in a report by the Urban Institute, they estimated that large institutional investors owned **574,000 **single-family homes as of June 2022 and their report was also based on 32 institutional investors. But, the Urban Institute actually aggregated data on all legal entities of the parent company because these institutional owners often use other names as the owner. They based their report on large investors owning a minimum of 100 single-family homes and they pulled data from a national property records database. The 574,000 figure is likely more accurate than GAO’s and the difference is most likely due to aggregating all of the legal entities under the parent companies.

https://bloustein.rutgers.edu/who-really-owns-the-u-s-housing-market-the-complete-roadmap/

This says the housing inventory is https://fred.stlouisfed.org/series/ACTLISCOUUS

institutional investors own 500,000 single family homes out of 80-100 million? That article you linked doesnt support your case. Even in (what I assume is) their strongest example institutional investors only own 10% of the rentals.

Where are you getting the 80-100 million homes? Are you including apartments?

Edit:

While institutional investors own roughly 2% of the single-family rental housing stock across the U.S., they own a much greater share of homes in certain markets, particularly in the southeast.

GAO estimates that institutional investors own 25% of Atlanta, GA’s single-family rental housing market, 21% of Jacksonville, FL’s, 18% of Charlotte, NC’s, and 15% of Tampa, FL’s single-family rental market. Areas that experienced the greatest influx of institutional investment after the 2007-2009 recession continue to have high rates of institutional investments in the single-family rental market.

no this is specifically single family homes

What is your source?

With all the profiteering by corporations since covid, the cost to build a house has gone up substantially. That narrows the consumer base and forces builders to reduce margins. Unless of course they build a “luxury” home or apt. Then you have large investors battling it out and snapping them up. So, it is more profitable to build luxury homes rather than homes for peasants. The investors can afford to set on the empty house and hold them if they can’t get the rent they want. In fact, many large investors don’t even bother to try to rent and just hold the property to have secure investments during market fluctuations. So they are building like crazy, but the homes they’re building can’t be afforded by the people that actually need them.

So, it doesn’t take a ton of housing being owned by big investors to fuck the market, they just have to be buying up all the new stock in what is already a limited market.Its not an issue of luxury home construction vs peasant home construction I doubt this even makes a dent. Investors are not buying up empty houses and sitting on them because they are to lazy to rent them out, thats absurd.

The issue is simply that housing development is to slow. The demand to build houses in higher density is there but local zoning laws and nimby residents block the developments. In cities where zoning laws were changed to allow development we see prices decrease.

Its not an issue of luxury home construction vs peasant home construction I doubt this even makes a dent. Investors are not buying up empty houses and sitting on them because they are to lazy to rent them out, thats absurd.

The issue is simply that housing development is to slow. The demand to build houses in higher density is there but local zoning laws and nimby residents block the developments. In cities where zoning laws were changed to allow development we see prices decrease.

I think what you’re highlighting is a symptom not the cause.

US homeowner vacancy rate is relatively stable over the past 10 years bouncing between 1-2%. You’ve highlighted a specific subset of homes where the rate is 8% and im expected to believe that this is causing house prices to inflate? I’m sorry but thats a weak argument. The article you linked says that luxery apartments were built because it was the only way to get acceptable returns from the high valued land and even then the vacancy rate is only 11% for 4-5 star apartments.

Once developers noticed that the demand wasn’t there they stopped building luxury apartments but the land value is still to high for them to build the affordable apartments that are in demand. This is a problem only city planning can address. The ways cities can address this is to invest in their own affordable housing units in these areas to drive down the prices by forcing competition. Zone extra land for housing. Basically just build more houses or reduce demand.

Wow, I guess I was wrong. You have convinced me. My facts obviously don’t hold a candle to against your strongly held opinion.

If they built luxury apartments, rich people would stop renting regular apartments, and the prices would go down

Rich people like cheap apartments too, lol.

I know a millionaire who lived in a single wide trailer with two bedrooms for most of his life. Finally built a nice brick house in his 60s.

People like that are a rare breed. What did the guy do for a living?

Owned 7 gas stations.

He’s only recently started spending his money. He’ll be 70 in a couple months.

He spends it on vacations for his grandkids mostly.

The idea that creating more housing stock will lead to prices decreasing is still economically sound.

A lot of places in the us are experiencing a gluten in high end housing… https://archive.is/20250110182457/https://www.wsj.com/real-estate/commercial/the-u-s-has-more-fancy-apartments-than-it-is-able-to-fill-f7bca968

A) This is a hoax account

B) You can still get cheaper housing if you don’t live in the whitest, red-lined-ass, suburban enclaves in your state

C) Even then, it doesn’t matter, because landlords primarily benefit from very low borrowing costs rather than low housing costs. A $300k house was still functionally unaffordable to anyone earning $45k/year, unless your credit score got you one of those sweet sub-3% ZIRP era loans. Renting was effectively paying a vig to a guy with a better interest rate than you.

D) ZIRP also flooded the market with the excess cash that made $300k basic bitch housing possible. And then turned those $300k homes into $600k homes 15 years later.

E) Build Public Housing

F) And municipal mass transit, so you don’t have to sit in traffic for a hour every day

deleted by creator

This is a hoax account

I hope so. The dissonance and lack of self-awareness in the post was so profound, my head is still ringing.

I saw quite a few Chase Passive Income posts and all of them feel like satire

Just pass a law taxing the shit out of single family homes used for income and a bigger tax on empty houses. Use the revenue to help people who go upside down on their mortgages due their primary residence due to the crash in housing prices.

Just pass a law taxing the shit out of single family homes used for income and a bigger tax on empty houses.

A simple reform in theory, but incredibly difficult to pass through a legislature that’s stuffed to the brim with real estate lobbyists and their clients.

This is the, “If I don’t do it, someone else will,” argument. Which is true.

There is always all least one other ass hole out there.

Exactly why no social ism works. Capitalism, communism, Georgism, liberalism, Marxism, anarchism, socialism. They’re mostly all good on paper but awful when put into effect because they don’t factor human nature. So long as there is the same trait within that led to our wild success as species number 1, we can never have good ideas play out how they were thought to. Instead we have we have those always looking for advantage to be number 1 of the number 1s. Psychopaths love power and personal security.

Arthur C. Clarke said something along the lines of “communism could’ve worked if only they had microchips” meaning that communism had problems with humans. An algorithmic socialism that requires everything to be fair is the only way to do it.

Who designs the algorithm?

Elon Musk vibe coding with grok.

Someone with a provable, undeniable, zero stakes in the outcome of publishing said algorithm, while being of such moral fortitude as to be un-corruptable. IMO, if you find such a person, you’re probably better off just putting them in charge.

Best bet is to raise the bar on any coordinated attempt to sabotage things. Multiple algorithms must be made by distinct parties, and the submissions compared against one another, and somehow averaged out (e.g. multiple running algorithms that vote amongst themselves) so that the only way to game the system is a very large and unlikely conspiracy.

Presumably anyone can, and people democratically vote on which algorithm is used. Direct democracy like this has its problems, but it’s a hell of a lot better than the oligarchy/plutocracy that we’re currently dealing with.

Would still need to figure out a solution for tyranny of the majority, though. Left unchecked, a majority populace can easily vote their way towards being a strict ethnostate.

For sure, though the tyranny of the majority is still strictly better than the tyranny of the minority, which we currently are dealing with.

I will

I’ll only skim a little off the top, promise

Just fractions of a socialism on every socialism. It adds up. I saw it in a movie.

Wouldn’t surprise me if that is how future civilizations (assuming we live that long) handle their administration. Laws are written algorithmically, almost like computer code, and simply translated for laymen to interpret. Maybe with an integrated parser service available to everyone that is capable of answering queries based on the strict programmed definitions it references.

This still invites the very likely possibility of one’s interpretation of a law differing from the intent, but that is already the case today, with the bigger problem being that there are often major disagreements at an institutional level where there should ideally be no uncertainty.

the problem will be the implicit biases of the lawmakers

Yep, not sure there will ever be a way around that either. An algorithm could possibly facilitate a more unbiased demographic representation of lawmakers, but that would require an original algorithm to establish those conditions in the first place.

The other factor is changing priorities/needs over time. People in the future could discover more problems that we are oblivious to today, and any algorithmic structure of law would need to be able to be easily amended in order to adapt. How would they prevent opportunists from abusing the amendment process?

At best, we see a streamlining of the court. Laws that are rigidly defined cannot be open to interpretation by any particular judge. But the act of creating laws would still be just as problematic unless we let ChatGPT do it, which invites the possibility of adding cyanide to public drinking water supplies because it’s better for the environment.

Communism is the perfect form of government when you have essentially infinite resources to the point where personal wealth is meaningless and a society that functions as a perfect meritocracy.

what is “the same trait within that led to our wild success as species number 1”?

i think the thing that made the difference was helping the “less fit” so that they could keep and transfer knowledge, do thinking and make tools

And also killing off the less fit if they’re not our own. Especially if resources are at stake. Or general conquest or control over a valley, zone, region, or some other thing for your kin, clan, group, community, eventually country, etc. The same behaviours we still exercise now, whether for political tribe, sport tribe, oil, subculture, parts of Gaza, religion, property portfolio, etc. You see now the etc. is just a long-standing timeline cut short.

Basically if it’s backed by a flag, colours, or other such meaningless symbolism of a group, it’s the underlying human nature still going hard. It is the “this is good for me therefore it is good to commit to” behaviour and the strongest come out on top whether decidedly good or evil.

But we do tend to band together when there’s an immediate threat bigger than ourselves—not like climate change since that’s us and is a slow threat easy to ignore day to day. I think it’s more a self-preservation thing than an everyone else preservation thing though. People jump ship for a better ship all the time, but they’ll fight for the fleet so long as they’re part of it.

And in between that the naive have exoected social ideologies can have any chance of achieving the blueprint of Eutopia they all envisioned. Yet history has only ever constantly said “Nope”.

the first paragraph is exactly “the law of the jungle” aka how other animals behave - it couldn’t have been the difference, since it’s the same. and then this extended to less tangible things

so it seems you agree, but you don’t realise it: humans are unique because they don’t follow this rule.

i read a book back when i was religious about the “temptation for good”, which the author argued was the proof for the existence of god, but i think it’s what made us different

it might be just me, but i feel bad for not helping people (i mean like beggars and the like), but the world has conditioned me that it’s a bad idea - you’ll get screwed over, you won’t have stuff, etc.as to climate change - there are many people spending billions of dollars and countless hours to make sure the average person doesn’t get to or doesn’t feel motivated to do anything, i don’t think it’s “natural” behaviour

history seems to forget that cuba exists, despite the fact that most of the world (especially the cia) trying to destroy it for more than half of a century

not that i’m saying cuba is a utopia, but they managed to survive and keep their more equitable system, again, despite constant assassination attempts and decades long embargoes

Communism tends to work pretty well until the US shows up with their military, and stamp it out.

By working “pretty well” you mean mass starvation, mass murders of the civilian population and complete government authoritarianism. Communism’s death toll rivals ww2 and thats with no foreign intervention.

By working “pretty well” you mean mass starvation, mass murders of the civilian population and complete government authoritarianism.

Communimsm and authoritarianism are opposites. Cannot have authoritarianism with a stateless and classless society.

Communism’s death toll rivals ww2 and thats with no foreign intervention.

What’s that death toll? Because in the US alone, capitalism kills about 40k per year, due to gatekeeping things like healthcare.

If that’s your opinion then no matter what I say you are going to hit me with the “true communism has never been tried”

Oh, it has been tried! For example, the Free People Territory in what is now Ukraine. Killed off by authoritarians pretending to be communists in the the USSR. Also, Neozapatistas in the Chiapas region. Cuba is doing a pretty fair shake at it, as well, and a lot of suffering there happening because of the myriad invasions, assassination attempts, and now economic embargo on them by the US. Rojava is doing a system that borrows a lot from communism (Democratic Confederalism).

So, since we’re doing economic death tolls: What is the death toll from just the US capitalist system? Like, 1 million dead during COVID, 40k per year from gatekeeping health care, how many died in Iraq? Afghanistan? How many indigenous people in the US have died from capitalism? I think just the last one puts the holocaust to shame…

Where has capitalism been tried that hasn’t resulted in massive death tolls?

Ironically, you completely fell into proving my point.

Somehow, I don’t think you’ll figure that out… Not today, maybe, but in the future, hopefully.

It’s easy guys, if nobody would rent, everyone could be a landlord, and we could let the rent rise to 10k a month or more even, and we all get rich on rent. How does nobody realize this? It’s irl infinite money glitch!

deleted by creator

Guillotines could give them purpose. Or is it the other way around?

The problem tellimg the country to… remove him? Thats a first

Parody account

?

Chase Passive Income is a satirical Twitter account poking fun at finance influencers

It’s just satire

YOU WON’T BELIEVE WHAT HAPPENED NEXT!!!

Nothing?

So far. Very frustrating. It feels like a dam of sand filling up until catastrophe strikes and all the energy is released at once.

deleted by creator